For Information on COVID19 Pandemic and Wildfire Recovery Funding

Working With Us

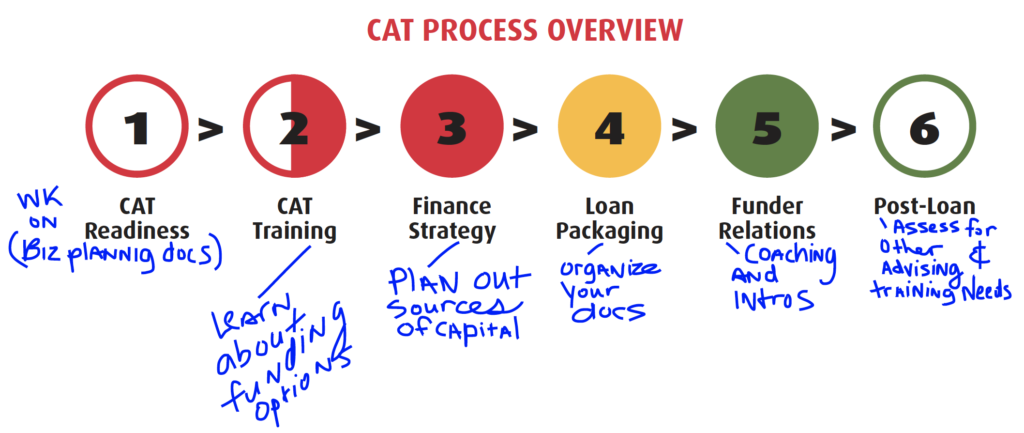

Typical CAT Process

- Business owners complete the new client inquiry.

- New clients to the SBDC register online for confidential business advising with local SBDC.

- CAT hosts initial client phone conversation and determine next steps.

- Clients work to get funding ready (see funding readiness requirements).

- Clients without experience raising capital may enroll in the CAT training program to accelerate their trajectory and expand their knowledge of different funding options.

- Clients work with CAT to explore the capital landscape and develop a finance strategy.

- CAT Advisors review client funding packages, provide feedback and suggest additions.

- CAT Advisors can also provide pitch coaching, funder strategy and connections.

NOTE: We have fine-tuned our process for optimal results. About 35% of clients we talk to complete this process. The ones that do have about a 75% chance of getting funded.

About Our Team

The Oregon SBDC Network’s Capital Access Team (CAT) is led by highly specialized SBDC advisors who engage clients via face-to-face and virtual advising (Phone, videoconferencing and e-mail). The CAT also provides access to education programs via online training and public workshops across the state for learning about the capital landscape and accessing capital.

The CAT works with clients referred to it by SBDCs, funders and community partners.

All advising is confidential, and each client is managed collaboratively with the local SBDC Advisor.