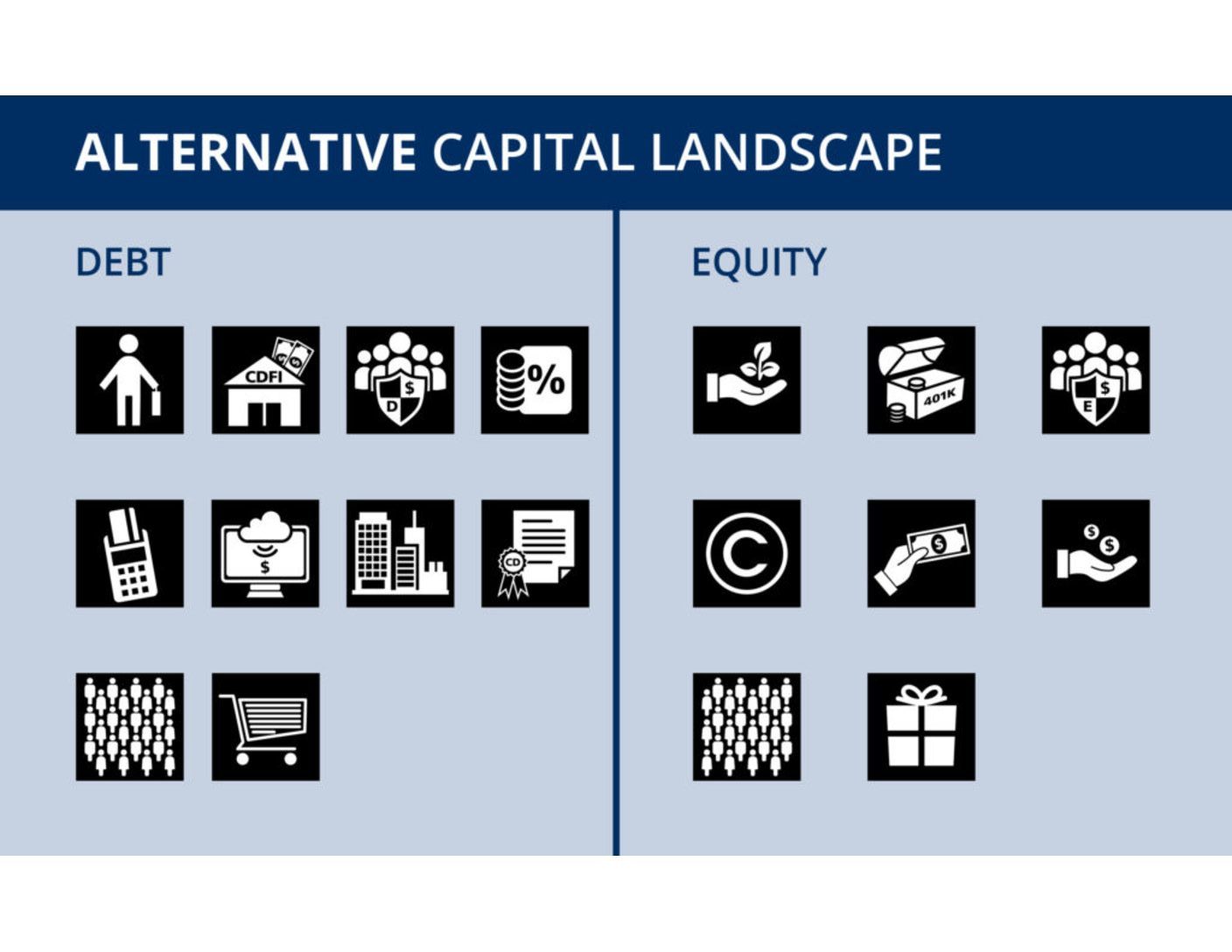

Seller Carry

Seller Carry also know “Owner Carry” or a “Seller Carry Contract” is when the owner/seller of an asset (equipment, real estate, business acquisition) self-finances, via direct loan with interest to the buyer. It is not uncommon for a portion of the purchase price from the sale of a business to be carried by the seller, especially if the buyer is an employee who needs assistance gathering enough capital to meet the seller’s price.

[See full description below]

Community Development Finance Institutions and Non-Traditional Lenders

Certified Community Development Financial Institutions (CDFIs) and non-traditional lenders fill the gaps where traditional lenders leave off. There is a whole category of lenders to fill the gaps when entrepreneurs don’t qualify for access to traditional (bank or credit union) debt programs due to issues with: (1) low credit scores; (2) lack of collateral; (3) lack of industry experience; (4) tight cashflow or other reasons. Non-traditional lenders and CDFIs tend to be mission-based and provide a wide range of small business capital solutions (including in some cases having access to SBA loan guarantee programs) for: micro-loans (less than $50K), equipment loans, term loans, permanent working capital and sometimes even credit lines.

[See full description below]

Community Capital Debt Securities

New administrative rules established by the Oregon Division of Financial Regulation in Jan 2015 allow small business’ registered in Oregon to raise up to $250K from Oregon residents (unaccredited investors) using either debt or equity. Specifically known as the “Oregon Interstate Offering Rules”, allow creative entrepreneurs to establish their own offering or deal terms in the form of an “offering document”.

[See full description below]

Factoring

When lines of credit are not available, factoring may be a short-term cashflow management solution to explore. For small businesses that carry qualified receivables, factoring companies may be able to offer business owners 80-90% advances on an invoiced receivable in exchange for giving up a percentage of the payment. In exchange for this advance on a receivable, business owners may pay finance fees equal to 3-7% of the total receivables, in addition to transaction and account setup fees.

[See full description below]

Merchant Cash Advances

Merchant Cash Advances or MCA is a type of upfront term loan for working capital typically repaid with high interest rates out of a merchant services account, often as either a percentage of future debit/credit sales or via regular daily/weekly automated clearing house (ACH) withdrawals. Repaying MCA cash-advances on a daily or weekly basis via ACH withdrawals can take a toll on small business cashflow.

[See full description below]

Online Unsecured Lenders

Several online non-traditional lenders serve small business capital needs with term loans and working capital lines of credit. These lenders require online applications, credit checks and promise rapid turnaround credit decisions. Most of this debt is unsecured meaning, there is no collateral, but due to the high credit risk of unsecured loans, interest rates generally reflect this with higher rates than traditional credit programs.

[See full description below]

Asset Based Lenders

Asset-based lenders (ABL) use business assets as collateral to provide entrepreneurs access to non-bank lines of credit or term loan products oftentimes to meet business cashflow or working capital requirements. Typical business assets include fixed assets like real estate and capital equipment, as well as current assets of inventory and receivables.

[See full description below]

Certificate of Deposit

Creative entrepreneurs sometimes use Certificate of Deposit Accounts (CDs) pledged by friends and family to fill much needed collateral gaps when their personal and business assets fall short of a bank’s collateral requirements to complete a loan request.

[See full description below]

Crowdfunded Debt

The advent of crowdfunding and peer-to-peer lending platforms like KivaZip.com, CommunitySourcedCapital.com, LendingTree.com and others make it possible to access crowdfunded debt at interest rates from 0-15%. These unsecured small business loan proposals are typically evaluated based on applicant credit score, number of years in business, and uses for the loan request. In some cases, successfully accessing this kind of funding depends on how well the prospective borrower can promote their crowdfunding campaign to friends, family, & followers through their networks.

[See full description below]

Prepaid Sales

Prepaid sales, also know as unearned revenues, are sometimes used as a debt-based crowdfunding strategy. Crowdfunders prepay for goods and services to support crowdfunding campaigns with the understanding of future delivery (fulfillment) of goods or services. This strategy can help small businesses raise funding for startup or expansion projects by creating a secondary sales channel. Different online platforms tailored for different industries are aimed at simplifying this approach.

[See full description below]

Seedfund

Seed funds provide small start-up capital investments in exchange for a small amount of equity, mentoring and sometimes incubator space. These small equity investments tend to be less than $50K and are oftentimes made in the form of convertible notes that eventually covert from debt into equity. Different seed funds tend to target different industry sectors such as software, hardware, life sciences, medical etc.

[See full description below]

Retirement Funds

After readily accessible capital sources are exhausted, some entrepreneurs may be tempted to look at retirement funds as an option for shoring up small startup budgets, filling expansion capital needs, or adding working capital when cashflow is tight. There are even specialized programs called ROBS (Rollovers as Business Start-Ups) that allow 401k account owners to roll over retirement investments without tax penalties, by purchasing founders stock in a startup C-Corporation.

[See full description below]

Community Capital Equity Securities

New administrative rules established by the Oregon Division of Financial Regulation in Jan 2015 allow small business’ registered in Oregon to raise up to $250K from Oregon resident (investors) using either debt or equity. Specifically known as the “Oregon Interstate Offering Rules”, allow creative entrepreneurs to establish their own offering or deal terms in the form of an “offering document”.

[See full description below]

Licensing

While not technically equity, licensing pays the owner (usually) a one-time upfront fee in exchange for providing use of something or access to information, intellectual property, process or activity. This can be a creative way for some companies with intellectual property (IP) assets to license or assign to others to create new funding streams.

[See full description below]

Royalties

While not technically equity, royalties are a type of licensing fees paid to owners based on asset usage often calculated as a percentage of sales revenue. Royalties can be a creative way for some companies with intellectual property (IP) assets or rights to license or assign to others as a way to create new funding streams.

[See full description below]

Grants

Grants are outside cash contributions sourced from different types of public, private and nonprofit organizations. Grant money tends to be earmarked for particular economic purposes and may oftentimes come with strict requirements such as: extensive applications, deadlines, matching funds and detailed reporting. Hundreds of grant programs exist and are setup to address different industries, needs and stages of business.

[See full description below]

Crowdfunded Equity

The development of the global crowdfunding space and associated online platforms has resulted in a few domestic equity-based crowdfunding platforms for entrepreneurs to choose from. Most of these equity crowdfunding platforms are designed to attract accredited investors like Fundable.com, but after Title IV of the JOBS Act, was implemented in June of 2015, equity crowdfunding opportunities expanded to non-accredited investors.

[See full description below]

Reward-Based Crowdfunding

One of the most common forms of crowdfunding is reward-based, where crowdfunders provide monetary contributions, oftentimes through an online platform like Kickstarter.com, in exchange for the promise of tangible and intangible rewards (typically of lesser value than their initial contribution).

[See full description below]