For Information on COVID19 Pandemic and Wildfire Recovery Funding

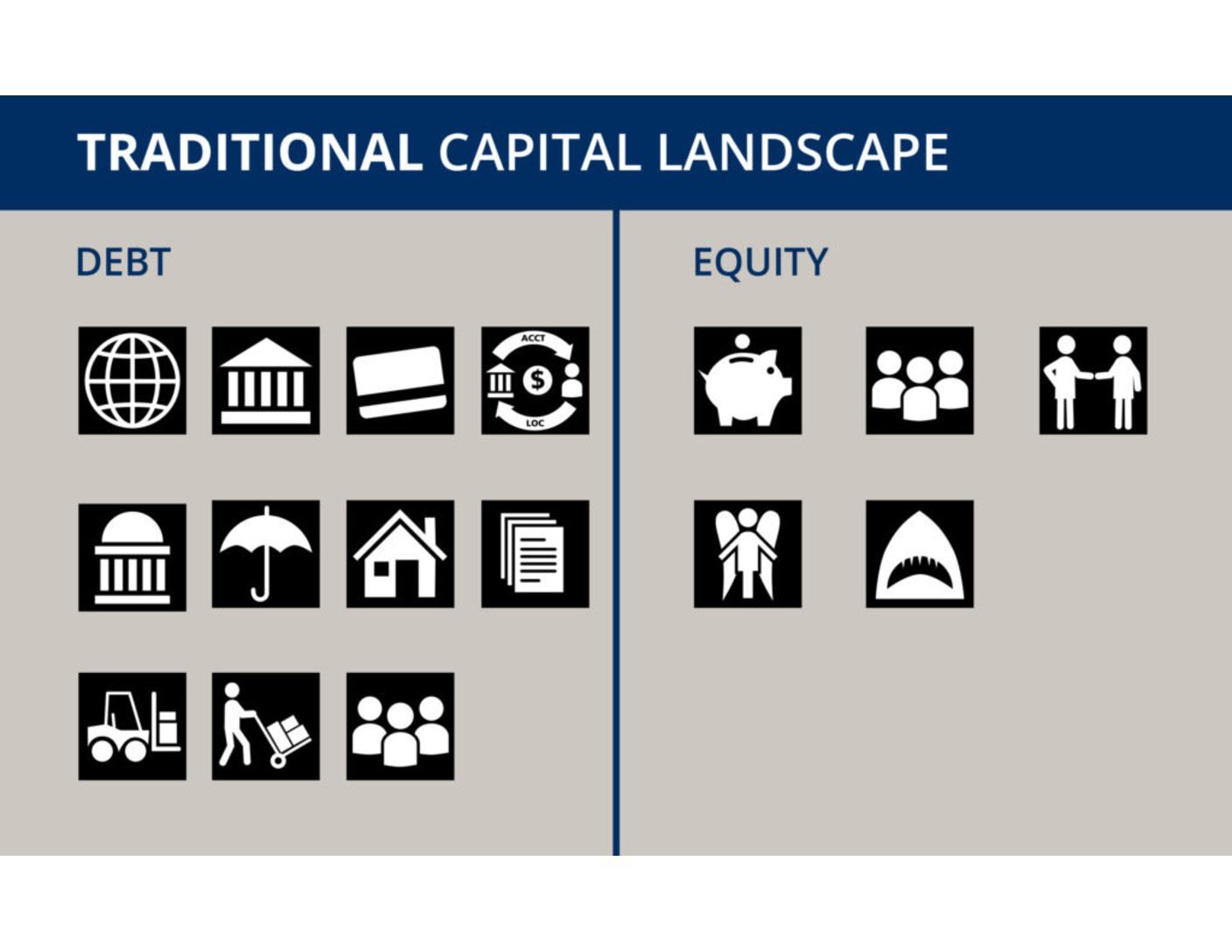

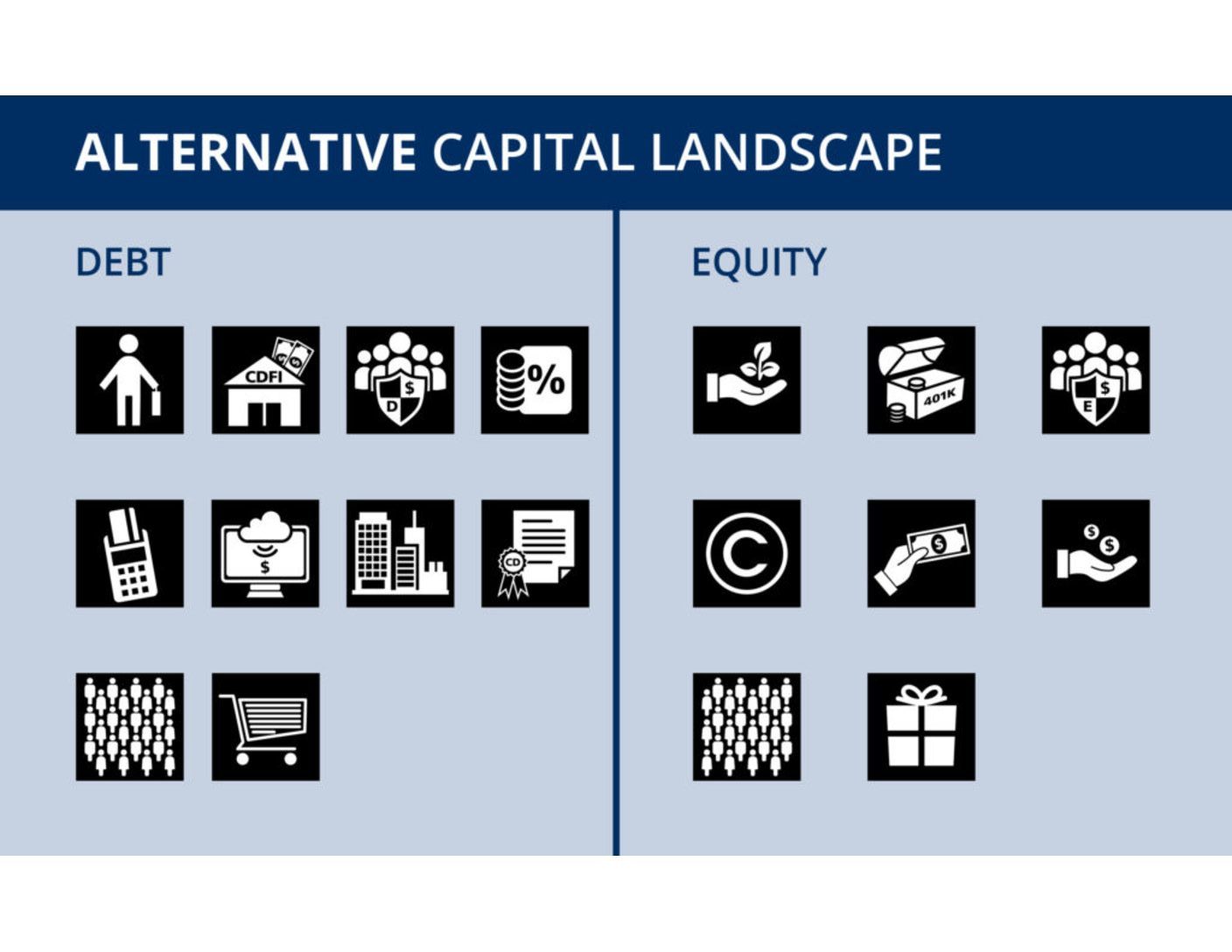

Capital Landscape

This page is dedicated to understanding different sources of capital arranged in what we call the “Capital Landscape”.

We have categorized these sources of capital as either “Traditional” (common sources folks are mostly familiar with) or “Alternative” (sources that are more on the creative side). We then separated whether these sources are debt (or debt-like) or equity (investments).

While it’s great to have so many different sources of capital, it’s most helpful if folks also know more about them and understand how and when to use them as part of a funding strategy.

We invite you to spend some time exploring the capital landscape to better understand different types of funding that might be available and encourage you to talk to an expert who can guide you through developing a funding strategy of your own.

You can mouse over the different icons below to get a gist, or dive deeper into the glossary definitions towards the bottom of the page. We will continue to update this page with new sources of capital as they become available.

International Trade Finance Tools

Several different international trade financing options are available including export working capital, term loans and export credit insurance.

[See full description below]

Banks and Credit Unions

Traditional banks and credit unions typically serve both consumer and commercial customers providing a full-suite of personal and business banking solutions including consumer and business credit, equipment loans, working capital, lines of credit, conventional and guaranteed term loans, merchant services, checking and savings deposit accounts.

[See full description below]

Credit Cards

Consumer and business credit cards are unsecured (uncollateralized) debt with interest rates from 0% (usually short-term introductory) to 28% (usually a penalty rate). Average rates are typically around 15%. Credit applications based on credit scores, payment history, income and existing balances.

[See full description below]

Lines of Credit

Lines of Credit obtained from banks and credit unions for covering short-term working capital needs such as employee payroll, labor, materials and inventory. Access to adequate working capital can be a critical factor for operating or growing a business.

[See full description below]

Government Direct Loan Programs

Hundreds of direct loan and finance programs exist from city, county, state and federal agencies. Many loan programs are setup to fund specific types of projects while others are more general.

[See full description below]

Government Loan Guarantee Programs

Several government loan guarantee programs exist through state and federally funded programs. These programs provide lenders loan guarantees, similar to insurance coverage, from 75%-90% of the total loan amount. Loan guarantee programs help to reduce the risk of losses to lenders, making it possible for them to approve loans they may not otherwise do.

[See full description below]

Home Equity Lines of Credit (HELOC)

Home Equity Lines of Credit leverage personal home equity built up over time on residential property. Using home equity as an asset, homeowners with personal income may qualify for a second mortgage that frees up working capital for other uses like home improvement projects or personal working capital. Interest rates on HELOC loans tend to be quite low.

[See full description below]

Leasing

Sometimes leasing can be an option for gaining access to new (and used) vehicles and other capital equipment. Leasing can often be done through specialty leasing companies, banks and credit unions, as well as directly by some equipment manufacturers and distributors. Rates vary depending on the type and condition of equipment, years in business, owner credit and business financial performance.

[See full description below]

Equipment Financing

Equipment Financing are loan programs specifically designed for borrowing to purchase different equipment, where the equipment is also collateral for the loan. Interest rates vary depending on the type and condition of equipment, years in business, owner credit and business financial performance.

[See full description below]

Vendor Terms

With vendor terms a company benefits from the generosity of its suppliers to “finance” the purchasing of goods or services with a promise to repay within a given timeframe as agreed. Vendor terms vary depending on leverage of the purchaser. Typical vendor terms are 15-30 days. Extended vendor terms may go beyond that into 45-90-120 days.

[See full description below]

Friends and Family Loans

One of the most common forms of debt capital are loans from friends and family. Whether used for startup or expansion capital, it's best to treat this source of capital with the same diligence and reverence as any other loan. One way to ensure against any misunderstandings it to have a promissory note in place that clearly delineates the terms of the loan between the two parties.

[See full description below]

Owner Equity (Savings)

Owner equity is the cash founders put into the business anytime, whether starting or growing the business, or investing personal cash into the business to bolster slow periods of low cashflow. Typically the initial owner equity contribution is the capital that establishes the company’s opening shares and in the case of multiple owners or business partners, it establishes a percentage of ownership for each partner. Owner equity contributions are also required as a portion of most loan deals, minimum contributions tend to be between 10-20%.

[See full description below]

Friends and Family Investments

When friends and family make equity contributions to help start or grow a business in the form of cash or business assets, it makes them investors and part owners in the company.

[See full description below]

Business Partners

Business partners are another potential source of equity funding that can bring startup or expansion capital into a business. Capital contributions can be in the form of cash or business assets. These equity investments equate to an ownership equity interest.

[See full description below]

Angel Investors & Private Equity

Angel Investors, Angel Conferences and Private Equity firms are other sources of equity funding that can bring startup or growth capital into a business. Investors typicaly seek a 5-10x return on their money within 5-7 years. Typical investments range from $50K to $5M. Angels and Private Equity investors are looking for both start-up and growth companies that can quickly and easily scale in size and market share, but also have a clear pathway towards a future exit.

[See full description below]

Venture Capital

Venture Capital is equity capital from professional VC firms focused on particular growth industry sectors where they have expertise. VC capital tends to come in during the later stages of a growth company in amounts from $1M-100’s of millions of dollars.

[See full description below]

Seller Carry

Seller Carry also know “Owner Carry” or a “Seller Carry Contract” is when the owner/seller of an asset (equipment, real estate, business acquisition) self-finances, via direct loan with interest to the buyer. It is not uncommon for a portion of the purchase price from the sale of a business to be carried by the seller, especially if the buyer is an employee who needs assistance gathering enough capital to meet the seller’s price.

[See full description below]

Community Development Finance Institutions and Non-Traditional Lenders

Certified Community Development Financial Institutions (CDFIs) and non-traditional lenders fill the gaps where traditional lenders leave off. There is a whole category of lenders to fill the gaps when entrepreneurs don’t qualify for access to traditional (bank or credit union) debt programs due to issues with: (1) low credit scores; (2) lack of collateral; (3) lack of industry experience; (4) tight cashflow or other reasons. Non-traditional lenders and CDFIs tend to be mission-based and provide a wide range of small business capital solutions (including in some cases having access to SBA loan guarantee programs) for: micro-loans (less than $50K), equipment loans, term loans, permanent working capital and sometimes even credit lines.

[See full description below]

Community Capital Debt Securities

New administrative rules established by the Oregon Division of Financial Regulation in Jan 2015 allow small business’ registered in Oregon to raise up to $250K from Oregon residents (unaccredited investors) using either debt or equity. Specifically known as the “Oregon Interstate Offering Rules”, allow creative entrepreneurs to establish their own offering or deal terms in the form of an “offering document”.

[See full description below]

Factoring

When lines of credit are not available, factoring may be a short-term cashflow management solution to explore. For small businesses that carry qualified receivables, factoring companies may be able to offer business owners 80-90% advances on an invoiced receivable in exchange for giving up a percentage of the payment. In exchange for this advance on a receivable, business owners may pay finance fees equal to 3-7% of the total receivables, in addition to transaction and account setup fees.

[See full description below]

Merchant Cash Advances

Merchant Cash Advances or MCA is a type of upfront term loan for working capital typically repaid with high interest rates out of a merchant services account, often as either a percentage of future debit/credit sales or via regular daily/weekly automated clearing house (ACH) withdrawals. Repaying MCA cash-advances on a daily or weekly basis via ACH withdrawals can take a toll on small business cashflow.

[See full description below]

Online Unsecured Lenders

Several online non-traditional lenders serve small business capital needs with term loans and working capital lines of credit. These lenders require online applications, credit checks and promise rapid turnaround credit decisions. Most of this debt is unsecured meaning, there is no collateral, but due to the high credit risk of unsecured loans, interest rates generally reflect this with higher rates than traditional credit programs.

[See full description below]

Asset Based Lenders

Asset-based lenders (ABL) use business assets as collateral to provide entrepreneurs access to non-bank lines of credit or term loan products oftentimes to meet business cashflow or working capital requirements. Typical business assets include fixed assets like real estate and capital equipment, as well as current assets of inventory and receivables.

[See full description below]

Certificate of Deposit

Creative entrepreneurs sometimes use Certificate of Deposit Accounts (CDs) pledged by friends and family to fill much needed collateral gaps when their personal and business assets fall short of a bank’s collateral requirements to complete a loan request.

[See full description below]

Crowdfunded Debt

The advent of crowdfunding and peer-to-peer lending platforms like KivaZip.com, CommunitySourcedCapital.com, LendingTree.com and others make it possible to access crowdfunded debt at interest rates from 0-15%. These unsecured small business loan proposals are typically evaluated based on applicant credit score, number of years in business, and uses for the loan request. In some cases, successfully accessing this kind of funding depends on how well the prospective borrower can promote their crowdfunding campaign to friends, family, & followers through their networks.

[See full description below]

Prepaid Sales

Prepaid sales, also know as unearned revenues, are sometimes used as a debt-based crowdfunding strategy. Crowdfunders prepay for goods and services to support crowdfunding campaigns with the understanding of future delivery (fulfillment) of goods or services. This strategy can help small businesses raise funding for startup or expansion projects by creating a secondary sales channel. Different online platforms tailored for different industries are aimed at simplifying this approach.

[See full description below]

Seedfund

Seed funds provide small start-up capital investments in exchange for a small amount of equity, mentoring and sometimes incubator space. These small equity investments tend to be less than $50K and are oftentimes made in the form of convertible notes that eventually covert from debt into equity. Different seed funds tend to target different industry sectors such as software, hardware, life sciences, medical etc.

[See full description below]

Retirement Funds

After readily accessible capital sources are exhausted, some entrepreneurs may be tempted to look at retirement funds as an option for shoring up small startup budgets, filling expansion capital needs, or adding working capital when cashflow is tight. There are even specialized programs called ROBS (Rollovers as Business Start-Ups) that allow 401k account owners to roll over retirement investments without tax penalties, by purchasing founders stock in a startup C-Corporation.

[See full description below]

Community Capital Equity Securities

New administrative rules established by the Oregon Division of Financial Regulation in Jan 2015 allow small business’ registered in Oregon to raise up to $250K from Oregon resident (investors) using either debt or equity. Specifically known as the “Oregon Interstate Offering Rules”, allow creative entrepreneurs to establish their own offering or deal terms in the form of an “offering document”.

[See full description below]

Licensing

While not technically equity, licensing pays the owner (usually) a one-time upfront fee in exchange for providing use of something or access to information, intellectual property, process or activity. This can be a creative way for some companies with intellectual property (IP) assets to license or assign to others to create new funding streams.

[See full description below]

Royalties

While not technically equity, royalties are a type of licensing fees paid to owners based on asset usage often calculated as a percentage of sales revenue. Royalties can be a creative way for some companies with intellectual property (IP) assets or rights to license or assign to others as a way to create new funding streams.

[See full description below]

Grants

Grants are outside cash contributions sourced from different types of public, private and nonprofit organizations. Grant money tends to be earmarked for particular economic purposes and may oftentimes come with strict requirements such as: extensive applications, deadlines, matching funds and detailed reporting. Hundreds of grant programs exist and are setup to address different industries, needs and stages of business.

[See full description below]

Crowdfunded Equity

The development of the global crowdfunding space and associated online platforms has resulted in a few domestic equity-based crowdfunding platforms for entrepreneurs to choose from. Most of these equity crowdfunding platforms are designed to attract accredited investors like Fundable.com, but after Title IV of the JOBS Act, was implemented in June of 2015, equity crowdfunding opportunities expanded to non-accredited investors.

[See full description below]

Reward-Based Crowdfunding

One of the most common forms of crowdfunding is reward-based, where crowdfunders provide monetary contributions, oftentimes through an online platform like Kickstarter.com, in exchange for the promise of tangible and intangible rewards (typically of lesser value than their initial contribution).

[See full description below]

GLOSSARY:

TRADITIONAL CAPITAL LANDSCAPE:

Traditional Capital Landscape – DEBT:

Banks and Credit Unions

Traditional banks and credit unions typically serve both consumer and commercial customers providing a full-suite of personal and business banking solutions including consumer and business credit, equipment loans, working capital, lines of credit, conventional and guaranteed term loans, merchant services, checking and savings deposit accounts.

TIP: Get to know your business banker before you need capital.

Credit Cards

Consumer and business credit cards are unsecured (uncollateralized) debt with interest rates from 0% (usually short-term introductory) to 28% (usually a penalty rate). Average rates are typically around 15%. Credit applications based on credit scores, payment history, income and existing balances.

TIP: Don’t use personal credit cards for business purposes. This reinforces the separation between personal and business finances.

Equipment Financing

Equipment Financing are loan programs specifically designed for borrowing to purchase different equipment, where the equipment is also collateral for the loan. Interest rates vary depending on the type and condition of equipment, years in business, owner credit and business financial performance. Financing equipment with debt adds equipment assets to a business balance sheet in addition to new liabilities.

TIP: Check with your accountant to understand the depreciation schedule for different types of equipment assets and learn how quickly you can write them off.

Friends and Family Loans

One of the most common forms of debt capital are loans from friends and family. Whether used for startup or expansion capital, it’s best to treat this source of capital with the same diligence and reverence as any other loan. One way to ensure against any misunderstandings it to have a promissory note in place that clearly delineates the terms of the loan between the two parties. At the very least, this should clarify the duration of the loan (term), the interest rate, payment amount and payment schedule. Templates are available online or from your attorney.

TIP: You might be surprised to learn that there is actually a minimum interest rate required by the IRS referred to as “Applicable Federal Rates” (AFRs). These rates established by IRS represent the absolute lowest interest rate required by a lender to prevent unnecessary tax complications. AFRs vary depending on the terms of the loan. Search online to find out the latest AFRs for you to incorporate into your promissory note.

Government Direct Loan Programs

Hundreds of direct loan and finance programs exist from city, county, state and federal agencies. Many loan programs are setup to fund specific types of projects while others are more general.

TIP: Ask a specialist or business advisor to see if there’s a government program that may be a good fit for your project.

Government Loan Guarantee Programs

Several government loan guarantee programs exist through state and federally funded programs. These programs provide lenders loan guarantees, similar to insurance coverage, from 75%-90% of the total loan amount. Loan guarantee programs help to reduce the risk of losses to lenders, making it possible for them to approve loans they may not otherwise do. The decision to use a loan guarantee is driven by lenders as they deem necessary. Loan guarantees add additional interest expense, fees, requirements and processing time to the lending process.

TIP: Oregon lenders have access to federal loan guarantee programs through the Small Business Administration and US Department of Agriculture as well as a state Credit Enhancement Fund offered by Business Oregon.

Home Equity Lines of Credit (HELOC)

Home Equity Lines of Credit leverage personal home equity built up over time on residential property. Using home equity as an asset, homeowners with personal income may qualify for a second mortgage that frees up working capital for other uses like home improvement projects or personal working capital. Interest rates on HELOC loans tend to be quite low.

TIP: Be cautious about tapping your home equity in order to make owner equity contributions or personal loans to fund business activities.

International Trade Finance Tools

Several different international trade financing options are available including export working capital, term loans and export credit insurance.

TIP: For companies with at least 20% of revenue coming from sales abroad, international trade finance programs may be an interesting source of financing to explore.

Leasing

Sometimes leasing can be an option for gaining access to new (and used) vehicles and other capital equipment. Leasing can often be done through specialty leasing companies, banks and credit unions, as well as directly by some equipment manufacturers and distributors. Rates vary depending on the type and condition of equipment, years in business, owner credit and business financial performance. Leasing allows business owners to expense lease payments and typically (depending on the type of lease) does not count as a business asset until the lessee buys the asset at the end of the lease.

TIP: Leasing typically reduces the amount of upfront owner equity required to obtain new equipment. Talk to your accountant for feedback on different leasing options for your business.

Lines of Credit

Lines of Credit obtained from banks and credit unions for covering short-term working capital needs such as employee payroll, labor, materials, payables and inventory while waiting for receivables to be paid. Access to adequate working capital can be a critical factor for operating or growing a business.

TIP: “Exercising” the Line through regular use and full repayment before renewal demonstrates responsible credit utilization to lenders and encourages annual renewal. Carrying static balances through annual renewal periods are likely to get refinanced as term loans and may result in reduction or loss of future credit lines.

Vendor Terms

With vendor terms a company benefits from the generosity of its suppliers to “finance” the purchasing of goods or services with a promise to repay within a given timeframe as agreed. Vendor terms vary depending on leverage of the purchaser. Typical vendor terms are 15-30 days. Extended vendor terms may go beyond that into 45-90-120 days. This exemplifies the use of “other people’s money” to support commerce.

TIP: If cashflow is tight, sometimes you can increase days cash by asking your vendors for longer terms. Depending on the relationship and the upside for the vendor, it may be worthwhile. Access to vendor terms can be a critical factor for operating or growing a business. Treat vendor relationships with respect and they will serve you well.

TRADITIONAL CAPITAL LANDSCAPE – EQUITY:

Angel Investors and Private Equity

Angel Investors, Angel Conferences and Private Equity firms are other sources of equity funding that can bring startup or growth capital into a business. Investors typical seek a 5-10x return on their money within 5-7 years. Typical investments range from $50K to $5M. Angels and Private Equity investors are looking for both start-up and growth companies that can quickly and easily scale in size and market share, but also have a clear pathway towards a future exit. Longer term strategic investors known as “Slow Money” investors, tend to focus on strategic portfolio investments with anticipated longer return on investment. Capital contributions can be in the form of cash or business assets. These equity investments equate to an ownership interest.

TIP: Oregon is home to several Angel Conferences geographically located around the state. Many of these angel conferences now accept applications year-round. While the time and effort required to participate in an angel conference can be extensive, there are considerable benefits to entrepreneurs including: (1) guidance on building a pitch deck; (2) valuable feedback on the business model from industry experts and veteran entrepreneurs; (3) exposure to future customers and potential investors.

Business Partners

Business partners are another potential source of equity funding that can bring startup or expansion capital into a business. Capital contributions can be in the form of cash or business assets. These equity investments equate to an ownership equity interest.

TIP: Intangible benefits of adding a strategic business partner can include complementary skills, access to new markets or sales channels, specialized industry expertise, access to closely held personal networks, and at times, augmenting the existing workforce capacity.

Friends and Family Investments

When friends and family make equity contributions to help start or grow a business in the form of cash or business assets, it makes them investors and part owners in the company.

TIP: When considering equity investments from friends and family, it is important to consult with a knowledgeable business attorney to ensure clear and proper documentation of each party’s ownership interest, rights and remedies.

Owner Equity (Savings)

Owner equity is the cash founders put into the business anytime, whether starting or growing the business, or investing personal cash into the business to bolster slow periods of low cashflow. Typically the initial owner equity contribution is the capital that establishes the company’s opening shares and in the case of multiple owners or business partners, it establishes a percentage of ownership for each partner. Owner equity contributions are also required as a portion of most loan deals, minimum contributions tend to be between 10-20%.

TIP: Be sure to capture owner equity contributions on the company balance sheet. This documentation will come in handy when meeting with bankers, investors and accountants.

Venture Capital

Angel Investors, Angel Conferences and Private Equity firms are other sources of equity funding that can bring Venture Capital is equity capital from professional VC firms focused on particular growth industry sectors where they have expertise. VC capital tends to come in during the later stages of a growth company in amounts from $1M-100’s of millions of dollars.

TIP: Prior to seeking VC or angel capital, it may be worthwhile for founders to seek out an independent company valuation so they have an independent 3rd party opinion of what the company might be worth.

ALTERNATIVE CAPITAL LANDSCAPE:

Alternative Capital Landscape – DEBT:

Asset Based Lenders

Asset-based lenders (ABL) use business assets as collateral to provide entrepreneurs access to non-bank lines of credit or term loan products oftentimes to meet business cashflow or working capital requirements. Typical business assets include fixed assets like real estate and capital equipment, as well as current assets of inventory and receivables.

TIP: Different ABL finance companies specialize in different types of ABL funding as well as different industry sectors. Ask around in your research on different ABL options to find one that may be a fit for you.

Certificate of Deposit

Creative entrepreneurs sometimes use Certificate of Deposit Accounts (CDs) pledged by friends and family to fill much needed collateral gaps when their personal and business assets fall short of a bank’s collateral requirements to complete a loan request.

TIP: If a lender is seeking a guarantor or cosigner to strengthen a loan request where collateral coverage is thin, this alternative strategy both strengthens the collateral by adding a (cash) CD and also limits the exposure to friends or family willing to pledge their assets.

Community Capital Debt Securities

New administrative rules established by the Oregon Division of Financial Regulation in Jan 2015 allow small business’ registered in Oregon to raise up to $250K from Oregon residents (unaccredited investors) using either debt or equity. Specifically known as the “Oregon Interstate Offering Rules”, allow creative entrepreneurs to establish their own offering or deal terms in the form of an “offering document”. Raising capital in Oregon using OIO Rules is still quite new, but others have used the Rules with success.

TIP: To see a sample of small businesses in Oregon that are trying to raise capital via the OIO rules, check out: HatchOregon.com

Community Development Finance Institutions and Non-Traditional Lenders

Certified Community Development Financial Institutions (CDFIs) and non-traditional lenders fill the gaps where traditional lenders leave off. There is a whole category of lenders to fill the gaps when entrepreneurs don’t qualify for access to traditional (bank or credit union) debt programs due to issues with: (1) low credit scores; (2) lack of collateral; (3) lack of industry experience; (4) tight cashflow or other reasons. Non-traditional lenders and CDFIs tend to be mission-based and provide a wide range of small business capital solutions (including in some cases having access to SBA loan guarantee programs) for: micro-loans (less than $50K), equipment loans, term loans, permanent working capital and sometimes even credit lines. Since these non-traditional lenders are filling gaps where traditional lenders (banks and credit unions) can’t extend credit, the interest rates are higher as a reflection of the higher credit risk. The higher interest rates of non-traditional lenders provide an incentive for business owners to “graduate” to traditional sources of capital like banks and credit unions with lower rates.

TIP: Check to see which CDFIs and non-traditional lenders cover your part of the state. While some operate regionally, others offer serve small business customers statewide.

Crowdfunded Debt

The advent of crowdfunding and peer-to-peer lending platforms like KivaZip.com, CommunitySourcedCapital.com, LendingTree.com and others make it possible to access crowdfunded debt at interest rates from 0-15%. These unsecured small business loan proposals are typically evaluated based on applicant credit score, number of years in business, and uses for the loan request. In some cases, successfully accessing this kind of funding depends on how well the prospective borrower can promote their crowdfunding campaign to friends, family, & followers through their networks.

TIP: Consult with a business advisor to see if crowdfunded debt might be a good fit for your business. Sometimes it makes sense to use crowdfunding as part of a large finance strategy. Sometimes it makes sense to use crowdfunding as part of a larger finance strategy.

Factoring

When lines of credit are not available, factoring may be a short-term cashflow management solution to explore. For small businesses that carry qualified receivables, factoring companies may be able to offer business owners 80-90% advances on an invoiced receivable in exchange for giving up a percentage of the payment. In exchange for this advance on a receivable, business owners may pay finance fees equal to 3-7% of the total receivables, in addition to transaction and account setup fees.

TIP: When shopping around for factoring solutions, be sure to ask about minimum program requirements, account setup fees, annual contract requirements, contractual inclusion of all customers vs some select customers, ask if a dual-party checks would be required.

Merchant Cash Advances

Merchant Cash Advances or MCA is a type of upfront term loan for working capital typically repaid with high interest rates out of a merchant services account, often as either a percentage of future debit/credit sales or via regular daily/weekly automated clearing house (ACH) withdrawals. Repaying MCA cash-advances on a daily or weekly basis via ACH withdrawals can take a toll on small business cashflow.

TIP: Be sure to read the fine print on MCA funding proposals and consult with a business advisor to see if MCA funding might be a good fit for your business.

Online Unsecured Lenders

Several online non-traditional lenders serve small business capital needs with term loans and working capital lines of credit. These lenders require online applications, credit checks and promise rapid turnaround credit decisions. Most of this debt is unsecured meaning, there is no collateral, but due to the high credit risk of unsecured loans, interest rates generally reflect this with higher rates than traditional credit programs.

TIP: Be sure to read ALL the fine print for online non-traditional funding proposals and consult with a business advisor to see if this type of funding might be a good fit for your small business.

Prepaid Sales

Prepaid sales, also know as unearned revenues, are sometimes used as a debt-based crowdfunding strategy. Crowdfunders prepay for goods and services to support crowdfunding campaigns with the understanding of future delivery (fulfillment) of goods or services. This strategy can help small businesses raise funding for startup or expansion projects by creating a secondary sales channel. Different online platforms tailored for different industries are aimed at simplifying this approach. Some examples are (1) CrowdSupply.com for manufacturers to pre-sell their goods; (2) Credibles.co to pre-sell food related items; (3) Kickstarter.com & Indigogo.com pre-selling all kinds of goods and services. As a form of debt, pre-paid sales show up on the balance sheet as a short-term liability until the revenue is “earned” or recognized.

TIP: Business owners using this crowdfunding approach would be wise to set aside enough of the prepaid sales to cover the cost of future fulfillment thus avoiding any disruption to cashflow resulting from fulfillment.

Seller Carry

Seller Carry also know “Owner Carry” or a “Seller Carry Contract” is when the owner/seller of an asset (equipment, real estate, business acquisition) self-finances, via direct loan with interest to the buyer. It is not uncommon for a portion of the purchase price from the sale of a business to be carried by the seller, especially if the buyer is an employee who needs assistance gathering enough capital to meet the seller’s price. As with loans from friends and family, minimum interest rates required by the IRS, referred to as “Applicable Federal Rates” (AFRs) apply.

TIP: In some cases, a seller carry might be used to bolster the buyer’s inadequate cash equity.

Alternative Capital Landscape – EQUITY:

Community Capital Equity Securities

New administrative rules established by the Oregon Division of Financial Regulation in Jan 2015 allow small business’ registered in Oregon to raise up to $250K from Oregon resident (investors) using either debt or equity. Specifically known as the “Oregon Interstate Offering Rules”, allow creative entrepreneurs to establish their own offering or deal terms in the form of an “offering document”. Raising your own capital in Oregon using OIO Rules is still quite new, but others have used the Rules with success.

TIP: To see a sample of small businesses in Oregon that are trying to raise capital via the OIO rules, checkout: HatchOregon.com

Crowdfunded Equity

The development of the global crowdfunding space and associated online platforms has resulted in a few domestic equity-based crowdfunding platforms for entrepreneurs to choose from. Most of these equity crowdfunding platforms are designed to attract accredited investors like Fundable.com, but after Title IV of the JOBS Act, was implemented in June of 2015, equity crowdfunding opportunities expanded to non-accredited investors. These equity crowdfunding platforms may benefit the entrepreneur by broadening their reach for an equity raise across the 50 states.

TIP: Entrepreneurs should consult with their CPA, attorney and business advisor to ensure raising equity capital is right for the business.

Grants

Grants are outside cash contributions sourced from different types of public, private and nonprofit organizations. Grant money tends to be earmarked for particular economic purposes and may oftentimes come with strict requirements such as: extensive applications, deadlines, matching funds and detailed reporting. Hundreds of grant programs exist and are setup to address different industries, needs and stages of business. One common grant program for small business development is an Individual Development Account or IDA. IDAs are setup as matching savings accounts where participating business owners are required to save money towards a goal and those dollars are matched by the granting organization sometimes two or three to one.

TIP: To find out about local grant programs, talk to a local business advisor.

Licensing

While not technically equity, licensing pays the owner (usually) a one-time upfront fee in exchange for providing use of something or access to information, intellectual property, process or activity. This can be a creative way for some companies with intellectual property (IP) assets to license or assign to others to create new funding streams.

TIP: Check with an IP Attorney and CPA to discuss proper documentation, accounting and record keeping.

Retirement Funds

After readily accessible capital sources are exhausted, some entrepreneurs may be tempted to look at retirement funds as an option for shoring up small startup budgets, filling expansion capital needs, or adding working capital when cashflow is tight. There are even specialized programs called ROBS (Rollovers as Business Start-Ups) that allow 401k account owners to roll over retirement investments without tax penalties, by purchasing founders stock in a startup C-Corporation.

TIP: While retirement funds may be an option, entrepreneurs should treat this as an option of last resort. Pulling out retirement dollars to fund a business startup is EXTREMELY risky with a real possibility of losing the investment altogether. Entrepreneurs considering using funds designated for retirement should seek counsel with their Financial Planner and Accountant to see if this is the right fit for the business.

Reward-Based Crowdfunding

One of the most common forms of crowdfunding is reward-based, where crowdfunders provide monetary contributions, oftentimes through an online platform like Kickstarter.com, in exchange for the promise of tangible and intangible rewards (typically of lesser value than their initial contribution).

TIP: Crowdfunding can sometimes be a valuable aspect of the overall finance strategy, especially, when paired with other sources of capital.

Royalties

While not technically equity, royalties are a type of licensing fees paid to owners based on asset usage often calculated as a percentage of sales revenue. Royalties can be a creative way for some companies with intellectual property (IP) assets or rights to license or assign to others as a way to create new funding streams.

TIP: Check with an IP Attorney and CPA to discuss proper documentation, accounting and recordkeeping.

Seedfund

Seed funds provide small start-up capital investments in exchange for a small amount of equity, mentoring and sometimes incubator space. These small equity investments tend to be less than $50K and are oftentimes made in the form of convertible notes that eventually covert from debt into equity. Different seed funds tend to target different industry sectors such as software, hardware, life sciences, medical etc.

TIP: Small business start-ups seeking equity investments and mentoring might spend some time researching seed fund resources available in their sector.