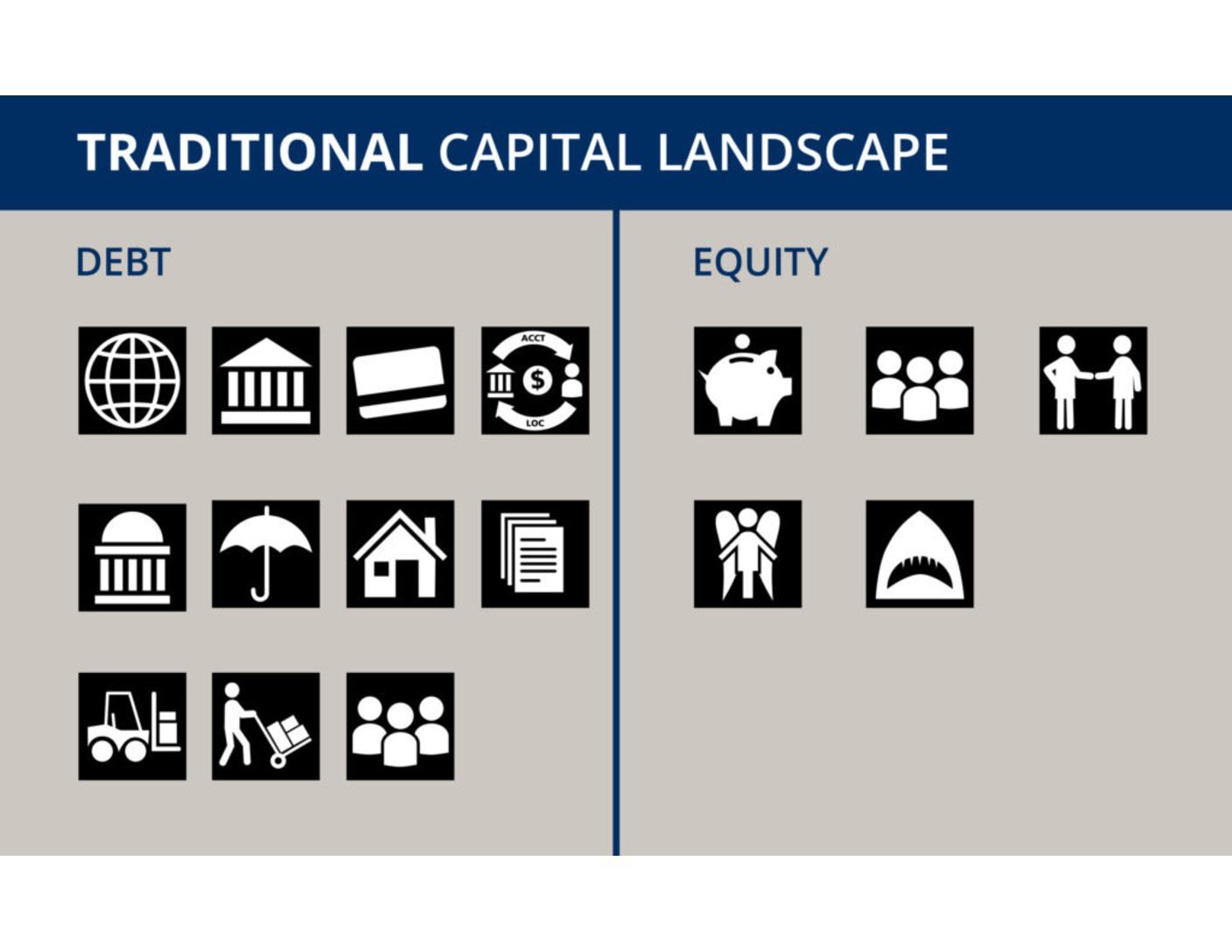

International Trade Finance Tools

Several different international trade financing options are available including export working capital, term loans and export credit insurance.

[See full description below]

Banks and Credit Unions

Traditional banks and credit unions typically serve both consumer and commercial customers providing a full-suite of personal and business banking solutions including consumer and business credit, equipment loans, working capital, lines of credit, conventional and guaranteed term loans, merchant services, checking and savings deposit accounts.

[See full description below]

Credit Cards

Consumer and business credit cards are unsecured (uncollateralized) debt with interest rates from 0% (usually short-term introductory) to 28% (usually a penalty rate). Average rates are typically around 15%. Credit applications based on credit scores, payment history, income and existing balances.

[See full description below]

Lines of Credit

Lines of Credit obtained from banks and credit unions for covering short-term working capital needs such as employee payroll, labor, materials and inventory. Access to adequate working capital can be a critical factor for operating or growing a business.

[See full description below]

Government Direct Loan Programs

Hundreds of direct loan and finance programs exist from city, county, state and federal agencies. Many loan programs are setup to fund specific types of projects while others are more general.

[See full description below]

Government Loan Guarantee Programs

Several government loan guarantee programs exist through state and federally funded programs. These programs provide lenders loan guarantees, similar to insurance coverage, from 75%-90% of the total loan amount. Loan guarantee programs help to reduce the risk of losses to lenders, making it possible for them to approve loans they may not otherwise do.

[See full description below]

Home Equity Lines of Credit (HELOC)

Home Equity Lines of Credit leverage personal home equity built up over time on residential property. Using home equity as an asset, homeowners with personal income may qualify for a second mortgage that frees up working capital for other uses like home improvement projects or personal working capital. Interest rates on HELOC loans tend to be quite low.

[See full description below]

Leasing

Sometimes leasing can be an option for gaining access to new (and used) vehicles and other capital equipment. Leasing can often be done through specialty leasing companies, banks and credit unions, as well as directly by some equipment manufacturers and distributors. Rates vary depending on the type and condition of equipment, years in business, owner credit and business financial performance.

[See full description below]

Equipment Financing

Equipment Financing are loan programs specifically designed for borrowing to purchase different equipment, where the equipment is also collateral for the loan. Interest rates vary depending on the type and condition of equipment, years in business, owner credit and business financial performance.

[See full description below]

Vendor Terms

With vendor terms a company benefits from the generosity of its suppliers to “finance” the purchasing of goods or services with a promise to repay within a given timeframe as agreed. Vendor terms vary depending on leverage of the purchaser. Typical vendor terms are 15-30 days. Extended vendor terms may go beyond that into 45-90-120 days.

[See full description below]

Friends and Family Loans

One of the most common forms of debt capital are loans from friends and family. Whether used for startup or expansion capital, it's best to treat this source of capital with the same diligence and reverence as any other loan. One way to ensure against any misunderstandings it to have a promissory note in place that clearly delineates the terms of the loan between the two parties.

[See full description below]

Owner Equity (Savings)

Owner equity is the cash founders put into the business anytime, whether starting or growing the business, or investing personal cash into the business to bolster slow periods of low cashflow. Typically the initial owner equity contribution is the capital that establishes the company’s opening shares and in the case of multiple owners or business partners, it establishes a percentage of ownership for each partner. Owner equity contributions are also required as a portion of most loan deals, minimum contributions tend to be between 10-20%.

[See full description below]

Friends and Family Investments

When friends and family make equity contributions to help start or grow a business in the form of cash or business assets, it makes them investors and part owners in the company.

[See full description below]

Business Partners

Business partners are another potential source of equity funding that can bring startup or expansion capital into a business. Capital contributions can be in the form of cash or business assets. These equity investments equate to an ownership equity interest.

[See full description below]

Angel Investors & Private Equity

Angel Investors, Angel Conferences and Private Equity firms are other sources of equity funding that can bring startup or growth capital into a business. Investors typicaly seek a 5-10x return on their money within 5-7 years. Typical investments range from $50K to $5M. Angels and Private Equity investors are looking for both start-up and growth companies that can quickly and easily scale in size and market share, but also have a clear pathway towards a future exit.

[See full description below]

Venture Capital

Venture Capital is equity capital from professional VC firms focused on particular growth industry sectors where they have expertise. VC capital tends to come in during the later stages of a growth company in amounts from $1M-100’s of millions of dollars.

[See full description below]